“A key benefit I have gained from working with CHAMP Ventures is learning the importance of working on the business, rather than in the business.“

Co-Founder Stephen Leibowitz

Co-Founder Stephen Leibowitz

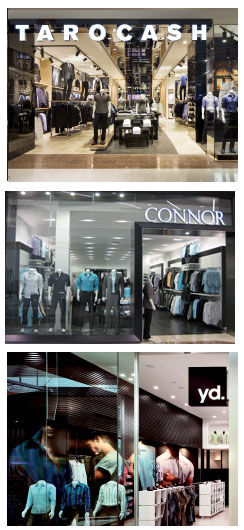

Retail Apparel Group (RAG) is a highly successful men’s apparel retailer trading under three distinct brands, namely Tarocash, yd and Connor.

Executive Chairman Stephen Leibowitz founded the business with his brother in 1987. In July 2004CHAMP Ventures was approached to buy out Stephen’s brother’s stake and to help Stephen to grow the business. At the time of our investment, the business had one brand – Tarocash – operating 43 highly profitable stores.

We partnered with Stephen to expand the Tarocash concept on a national basis and to develop a portfolio of brands. In March 2007, RAG opened its first Connor store focused on an older demographic. In July 2007, RAG acquired yd which was quickly and successfully integrated.

Initially Stephen was heavily involved in all aspects of the business in his role as CEO. In 2007 Gary Novis was hired and he was appointed CEO in 2008, with Stephen moving to Executive Chairman. In addition, the depth of the executive team was increased across all areas of the business.

During our investment, earnings trebled and the network grew to more than 250 stores across Australia and New Zealand. In early 2011, RAG was sold to Navis Capital to fund its next phase of growth. Management re-invested alongside Navis. The movement from a founder-reliant, one-brand business to a corporatized portfolio of brands led to RAG being an attractive secondary buy-out candidate.