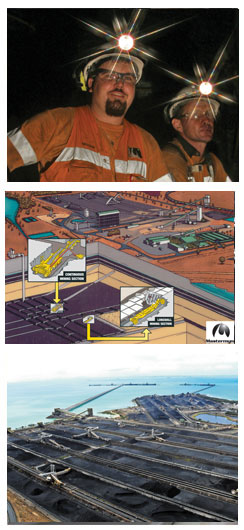

Mastermyne is a specialist provider of services to the Australian underground coal mining industry. It is a market leader in Queensland’s Bowen Basin and has a growing presence in New South Wales.

By 2005 founders Andrew Watts and Darren Hamblin had grown Mastermyne from an idea in 1996 to one of the Bowen Basin’s largest underground coal mining contractors. The business had reached $33m in revenue and both founders were running the business as their core asset. Andrew and Darren sought CHAMP Ventures’ involvement as part of a managed succession plan. Both wanted to be able to pursue opportunities outside of Mastermyne but recognised they needed external skills to achieve this whilst continuing to grow the business.

CHAMP Ventures became a significant minority shareholder in September 2005. Key senior managers became shareholders at the same time.

Following CHAMP Ventures’ investment, Mastermyne’s revenue and profits increased by almost three times. The business grew organically and via six strategic acquisitions which expanded Mastermyne’s geographic reach and service capabilities. Profits were reinvested into the business including selective expansion of the equipment fleet. CHAMP Ventures helped transition day to day management of the business from the founders to a CEO, developed the second tier management team and built an in-house finance team.

Mastermyne listed on the Australian Stock Exchange in May 2010 (the only private equity business listed in 2010) and performed strongly in the period after listing.

Click here to view the case study on Amdel.

Click here to view the case study on Retail Apparel Group.